Policies and Procedures Manual

Approved by HEAB February 16, 2001. Last Updated September, 2018.

We are working to get this document updated as soon as possible. Thank you. January, 2021

Dear Colleagues,

The Higher Educational Aids Board (HEAB) is pleased to present this Policies and Procedure Manual. This document provides an overview of the agency's structure, functions, policies, mission, and history. It also includes information related to what financial aid is, how one applies, and how eligibility for financial aid is calculated. Each of the programs HEAB administers is outlined in great detail. This manual should assist you, as a Financial Aid Administrator, through the process of awarding and vouchering funds administered through HEAB.

It is our expectation that the on-line version of this manual will be updated as changes occur. You will then have the opportunity to access current information. We also expect that this document will expand due to changes, clarifications, and so on. Your thoughts and suggestions are welcome. We realize that this is the first edition and expect change.

It is this agency's mission to ensure that all students are provided equal access and diversity in obtaining a higher education and to make certain the funds for each program we administer are distributed in a fair, equitable, and timely manner. We believe this mission can be accomplished in part by working hand in hand with you, the Financial Aid Administrator. We appreciate your dedication and service. We hope this manual will be of assistance to you.

Table of Contents

Chapter 1 Introduction

Chapter 2 Overview of Financial Aid

- What Is Financial Aid?

- Applying For Financial Aid

- Filling Out The FAFSA

- Need Calculation and Expected Family Contribution

- Calculations and Formula

- Federal and State of Wisconsin Financial Aid Programs

Chapter 3 School Eligibility

Chapter 4 Student Eligibility

- General Eligibility Provisions

- Child Support Delinquency

- Selective Service Registration

- EdVest

- Residency

- Effects of Professional judgment Adjustment

- Outside Funding Sources

Chapter 5 State of Wisconsin Financial Aid Programs

- Academic Excellence Scholarship

- Hearing/Visually Impaired Student Grant

- Indian Student Assistance Grant

- Minority Undergraduate Retention Grant

- Minority Teacher Loan

- Nursing Student Loan

- Talent Incentive Program Grant

- Teacher of the Visually Impaired Loan Program

- Wisconsin Grant - University of Wisconsin

- Wisconsin Grant - Wisconsin Technical Colleges

- Wisconsin Grant - Tribal Colleges

- Wisconsin Grant - Private Non-Profit

- School Specific Programs

- Inactive Loan Programs

Chapter 6 Notification Report

Chapter 7 Error Reports

Students Rejected in Analysis Error ReportStudents Requiring Eligibility Review Error ReportGraduate, Non-resident Error Report

Chapter 8 File Maintenance

- File Maintenance Template

- File Maintenance Template for WG-PNP schools with Multiple Tuition Levels

- File Maintenance Process

Chapter 9 Vouchering

Chapter 12 Reconciliation Data

Chapter 13 HEAB Audits

Chapter 14 Conflict of Interest

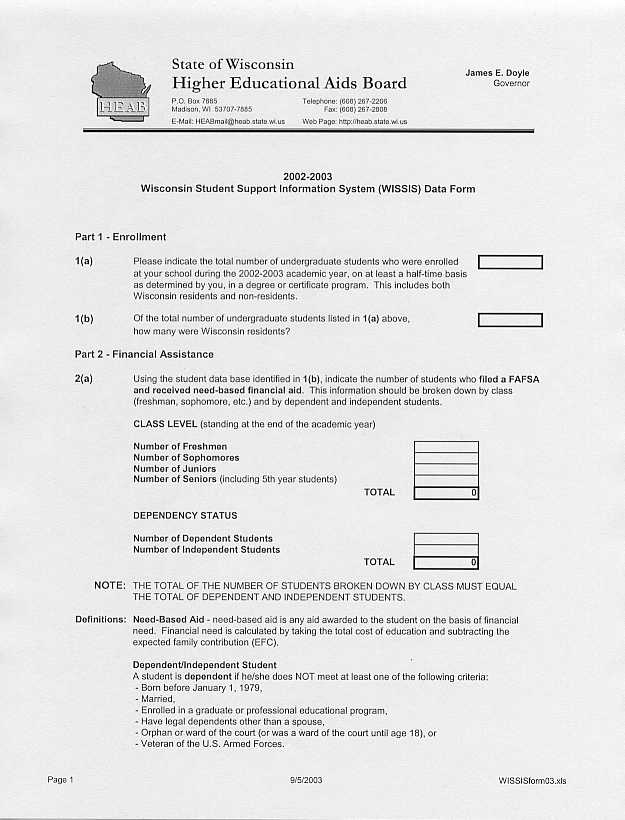

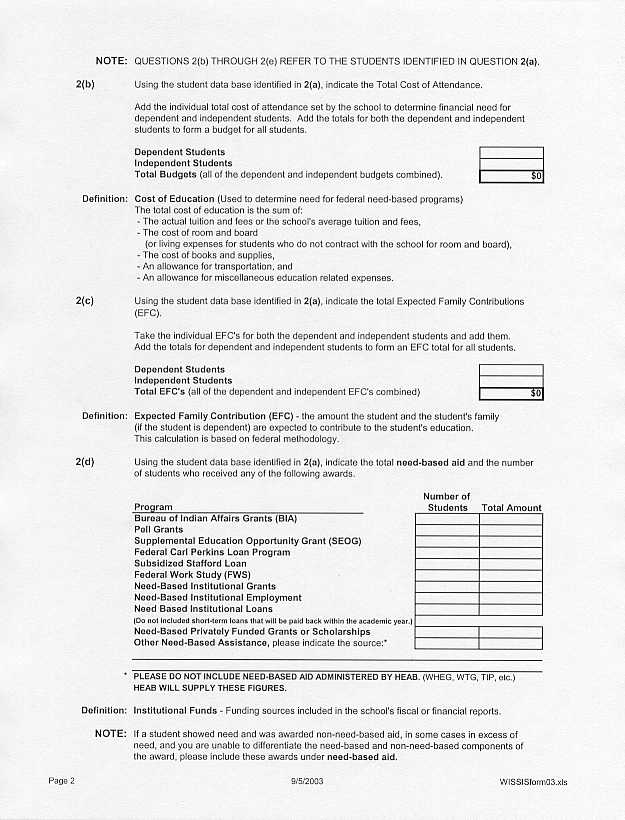

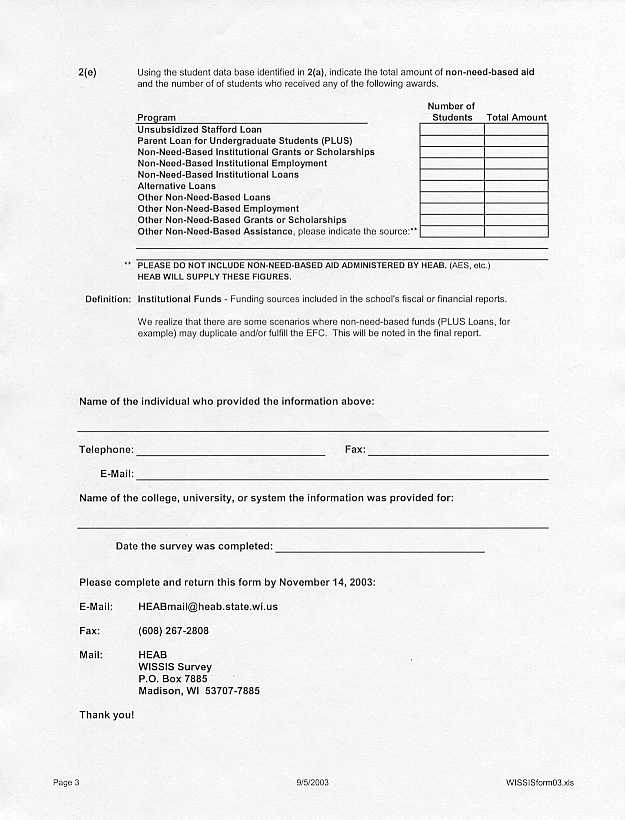

Chapter 15 WISSIS Data

Chapter 16 HEAB Annual Calendar

Chapter 17 Revision of Manual

Chapter 18 State Administrative Code

Chapter 19 State Statutes

Chapter 1 - Introduction

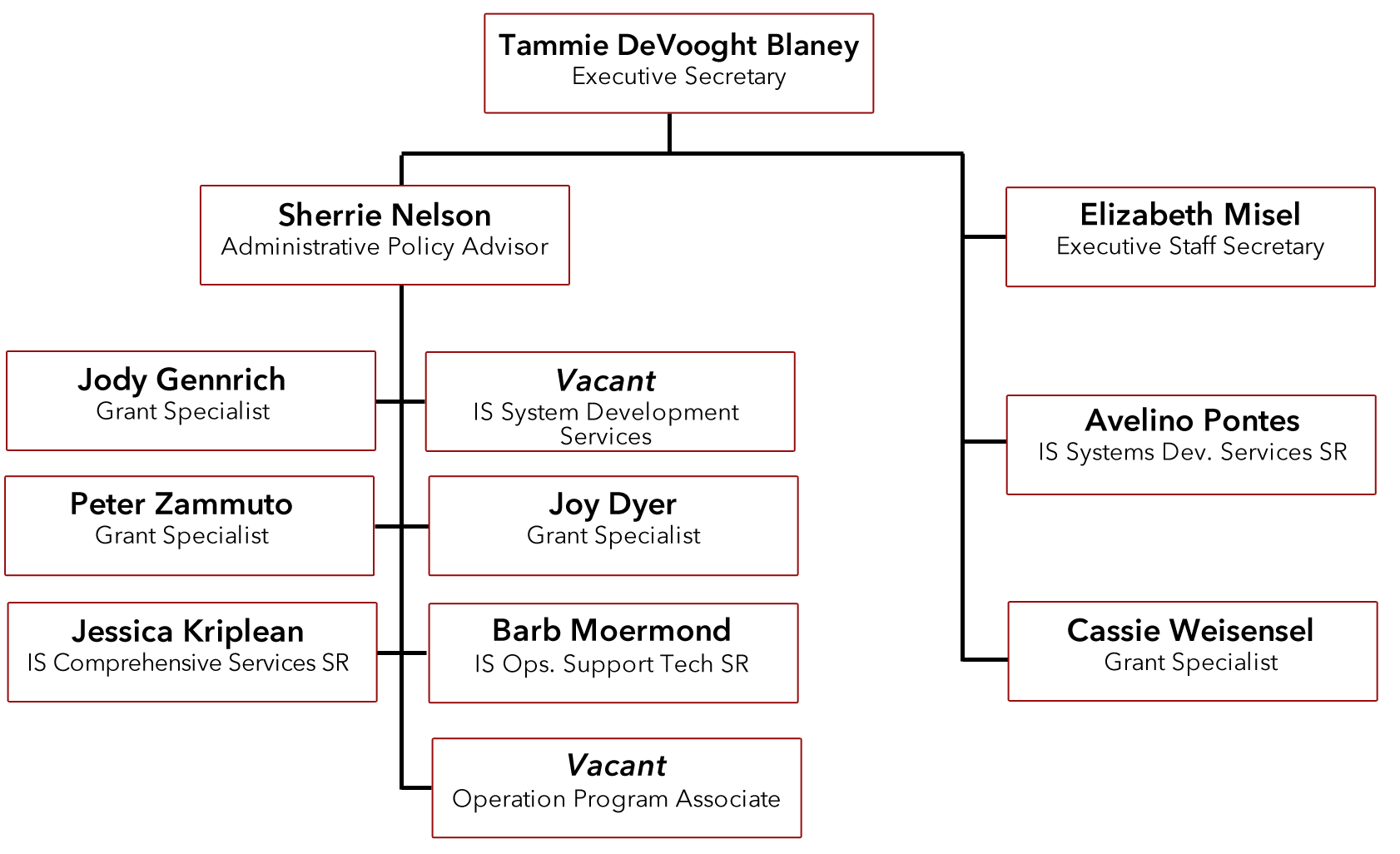

Agency Structure

The Higher Educational Aids Board is a part-time independent policy-making board composed of ten members appointed to serve at the pleasure of the governor. The Governor appoints one member from the Board of Regents of the University of Wisconsin System; one member from the State Board of the Wisconsin Technical College System; one member who is a trustee of an independent college or university to represent such independent institutions; one student and one financial aid administrator each from within the University of Wisconsin System, Wisconsin Technical College System and independent institutions; one citizen member to represent the general public; and the State Superintendent of Public Instruction.

The Executive Secretary of HEAB is appointed by and serves at the pleasure of the Governor. The Executive Secretary makes policy recommendations to the Board; carries out policy directives from the Governor, Legislature and Board; and is responsible for initiating and carrying out all administrative direction and responsibilities of the agency. The Deputy Executive Secretary serves outside the classified service at the pleasure of the Executive Secretary. All other permanent agency staff are in the classified service. The organizational chart of the agency below reflects the most recent structure.

Agency Functions

The agency's major operational responsibilities fall into four distinct categories, which include grants/scholarship programs, student loans, reciprocal agreements and tuition capitation programs. First, the administration of the state's student grant/scholarship programs includes the expenditure of over $123,744,300 during 1999-2001. All of these funds were secured from General Purpose Revenue tax funds (except for $1,409,498 in federal funds). The majority of these programs are based upon the federally determined student and/or parental contributions, and hence the financial need of the student recipients. Total awards exceeded 109,000 from over 355,000 Wisconsin undergraduates who applied for assistance last year.

HEAB continues the collection of outstanding loans for the following programs: Minority Teacher Loan; Teacher Education Loan; and the Teacher of the Visually Impaired Loan.

Two tuition capitation agreements comprise the last major operational responsibility of the agency. The Board has tuition capitation agreements with both the Medical College of Wisconsin and the Marquette University School of Dentistry. These agreements provide funds to the two institutions to train Wisconsin residents as physicians and dentists. During 1999-2001, the total appropriation on behalf of the Medical College was $8,210,200 and $2,334,000 for the School of Dentistry.

Present Board Policies

In 1968, a rational policy and framework for Wisconsin's Student Financial Aid Structure was established. Today, the rational and policy frameworks continue to operate. Essentially, there are two broad goals, Universal Educational Opportunity and Educational Diversity or "Freedom of Choice", are looked upon as educational goals which can be achieved, in part, through the financial aid structure.

The first goal is to eliminate financial barriers and thereby ensure an educational opportunity for all Wisconsin citizens commensurate with the desires and abilities regardless of their financial circumstances. This goal does not imply that the same educational experience need be provided to all students but it does require that all students be given an equal opportunity to pursue education consistent with their individual abilities, interests and ambitions. It has been recognized that if society is to achieve the goal of equality of opportunity it must first ensure the equality of educational opportunities. Every citizen has a right to participate in the economic, social, and political aspects of our society. Education provides the opportunity to exercise the right of full participation and must be made equally to all.

The second goal of the Financial Aid Structure is to support existing Educational Diversity by allowing students freedom to choose among the various educational offerings. Educational Diversity implies a wide range of academic environments, programs, and course offerings as well as diversity in sponsorship e.g. public and private. A comprehensive educational environment is one which offers technical training in addition to collegiate programs not of a technical nature; one and two year programs as well as four year programs.

In order to implement the two goals described above, the following operational policies were established to serve as guideposts of the Financial Aid Structure:

- Financial aid is distributed on the basis of the student's financial need in order to maximize financial resources and thereby insure an educational opportunity to the greatest number of students.

- Equalization supports diversity and insures freedom of choice by placing all students in the same relative position in relation to governmental instructional subsidies.

- Awarding for excellence requires that academic excellence be recognized.

- Shared responsibility recognizes the multiple responsibilities of the student, the student's parent(s) or spouse, government, and private sources to contribute to educational costs.

- Recognizing the unique financial needs of the disadvantaged suggests that it is a responsibility of the financial aid structure to recognize and relate to the unique financial needs of the economically disadvantaged.

- Maximization of resources emphasizes the need to maximize the contribution of financial aid resources provided by all sources including students, spouses, parents, government, institutions, and private sponsors.

- Administrative coordination and simplicity recognizes the importance of providing a coordinated, equitable, efficient, and responsive administrative framework designed to implement the other policies enumerated above. Meeting this policy goal and, in addition, fulfilling the legislative mandate of providing an annual review of the State's Financial Aid Structure, suggests that a single governmental body should be responsible for the administrative coordination of the State's financial aid programs.

HEAB Mission Statement

"The Wisconsin Higher Educational Aids Board will work to ensure that all Wisconsin residents are provided equal access to a higher education, to promote diversity on Wisconsin college and university campuses, and to distribute all funds in HEAB administered programs using fair, equitable and timely procedures."

History of the Higher Educational Aids Board

The Higher Educational Aids Board (HEAB) was created by statute on June 30, 1964 as the Commission for Academic Facilities. The original purpose of the board was to distribute federal campus construction funds. In September 1965, the name of the agency was changed by statute to the State Commission for Higher Educational Aids, with the present name being designated two years later. Along with the change of name came the assignment of the first grant and scholarship programs funded by the State. These programs were the outgrowth of the Governor's scholarship and Loan Committee of 1965. The two most important policies followed in the creation and the initial student aid programs were those of student financial need for the determination of the eligibility and award amount, and that aid should be available to Wisconsin residents attending both public and private institutions of higher education. The Board also received responsibility for the State Student Loan Program in 1966 with loans being made directly from State controlled funds.

The first ten years of the Board's existence can be viewed as a period of experimentation as well as growth. The agency became responsible for administering the federal Guaranteed Student Loan Program during this period as the federally funded construction and educational equipment programs came to an end. Many short lived State programs were approved, operated for a few years and then were discontinued, all prior to 1976. They included virtually every concept of student assistance with the exception of employment. There were grants and loans for professional degree students; teacher training stipends and scholarships with repayment provisions if teaching wasn't actually done; and grants for minority and disadvantaged students. In all, eight programs were started and were either discontinued or merged in successor programs.

The effective end to this decade of change came with legislation that, for the most part, followed the findings of a Legislative Council Committee, which was requested by the co-chairs of the Joint Committee on Finance in 1974-75. Programs were ended or merged and the grant structure the Board still administers today was put into place. Two large grant programs tied into the federal financial aid structure were the central feature, flanked by several smaller grant programs targeting additional aid to the most needy. Within a few years, the State Loan Program was removed from State funds and student loans were made from bond issue proceeds. This program grew rapidly along with the parallel increase in private lender loans. By 1980, a second large loan program was created from bond funds, the Wisconsin Health Education Assistance Loan (WHEAL), with assistance going to dental and medical students enrolled in Wisconsin institutions.

The second decade came to an end in 1984 when the agency's Board, sitting in its capacity as the Board of the Wisconsin Higher Education Corporation (now the Great Lakes Higher Education Corporation), voted to make the corporation independent of both the Higher Educational Aids Board and State control. This was done and the agency was left with grant programs, responsibility for the two loan programs and the size of the staff returned to its 1966 level. Within the next two years, bond authority for the loan programs expired and the agency withdrew from the business of making loans under these programs.

Since 1984, the agency has concentrated on better delivery of student grant aid and collection of the remaining student loans for which it is responsible. In addition, several new aid programs have been added to the agency's mission and the concept of employment and forgiveness of loan repayment has returned. During 1991, the remaining State Student Loans were sold to an Ohio bank and the State's general fund received $34,000,000 during 1991-92 from the sale.

The 1995-97 State Budget would have eliminated the Higher Educational Aids Board and transferred the staff, functions and appropriations to a new Department of Education, effective July 1, 1996. The Education Commission would have assumed the responsibilities of HEAB. The 1995-97 Budget also eliminated the Council on Financial Aids, effective January 1, 1996. The State legislature recreated the HEAB in 1997 and restored the Executive Secretary position.

A new program, the Teacher Education Loan Program, was established in 1997. A provision of the 1997-99 budget expanded HEAB'sWisconsin Grant program to include students enrolled at tribally controlled colleges in the state. A provision in the 1999-2001 budget created a WG program, funded by gaming revenues, for students at tribally controlled colleges and eliminated the Tribal part of theWisconsin Grant program. In 2000 the Teacher of the Visually Impaired Loan Program was established. A provision of the 2001-03 budget created the Nursing Student Loan Program.

Chapter 2 - Overview of Financial Aid

What Is Financial Aid?

Financial aid is money or other financial assistance available to help a student with the costs associated with attending a post-secondary institution. The amount of financial aid a student receives can be based on many factors, including scholastic achievement. However, financial need is most often the major determining factor. Financial need is the difference between the cost of attendance and the amount a student and his/her family is expected to contribute to the education. Financial Aid is available through a variety of sources, including the federal and state governments, the educational institution, and other public and private sources.

There are four basic types of financial aid:

- Scholarships - this is an award given to a student based on achievement in a particular area, such as academic excellence, athletic excellence or outstanding achievement in a specialized area. Scholarships do not need to be repaid.

- Grants - this is an award given to a student and is most often based on the financial need of the student. Grants do not need to be repaid.

- Loans - this type of aid may be available to both students and parents. In general, student loans are low-interest and repayment does not begin until after the student graduates from school or falls below half-time status. Some loans are available with an interest subsidy. Subsidized loans are usually based on financial need. Unlike other forms of financial aid, loans must be repaid.

- Student Employment - this type of aid may be offered to the student based on financial need. The work is usually part-time and limited to a specified number of hours per week. The employment is usually limited to the academic year. Student employment can be either need or non-need based.

Applying For Financial Aid

In order to apply for any financial aid, the student must complete the Free Application for Federal Student Aid (FAFSA). The application is available both in paper form and electronically. The paper form can be obtained from any post-secondary institution's financial aid office, a high school guidance counselor or HEAB. The electronic form is available at https://studentaid.gov. There is no charge for processing the form in either format.

The FAFSA should be completed at least six to eight months before the student expects to begin school. This means the form should be completed as soon as possible after October 1st of the student's senior year in high school. If the person filling out the form is not a high school senior, the application should be completed as soon as possible after October 1st prior to the academic year the student wishes to attend school. The student does not need to know the specific institution he/she wishes to attend. The FAFSA has space for multiple prospective schools to be listed. It can take as long as four to six weeks to process the form (depending on the format used to submit the information), send the information to the institution(s) listed on the form and for the school to inform the student of the financial aid package to be offered.

An individual school may have supplemental forms that need to be completed before financial aid awards can be made. There may be costs associated with the processing of these forms.

Individual schools may have specific filing deadlines that need to be met. The student should check with each institution to learn the deadlines involved. At times, HEAB may run into situations where the number of students who are eligible for aid exceeds the available funds. For this reason, students are urged to submit a FAFSA as soon as possible to ensure maximum eligibility.

If loans are part of the financial aid package, additional forms will need to be filled out by the student.

Filling Out the FAFSA

The FAFSA is used to collect financial information about the student and his/her family. The form needs to be completed for each academic year the student plans to attend school. A valid social security number is needed for the student to complete the FAFSA.

The FAFSA has six sections that need to be completed:

- questions about the student;

- questions about the student's school plans;

- questions about the student's finances;

- questions about the student's household (if applicable);

- questions about the student's parent(s) or spouse (if applicable); and

- the student's college(s).

If the student wishes to complete and submit the FAFSA electronically, visit the FAFSA website at https://studentaid.gov. Once at the website, the student should follow the instructions for completing and submitting an electronic FAFSA. A copy of the completed paper form should be made before it is submitted to the processor. This makes it easier to make sure the form has been processed correctly.

A completed paper FAFSA should be sent to:

Federal Student Aid Programs

P.O. Box 4001

Mt. Vernon, IL 62864-8601

Once the FAFSA is processed, the student will receive a Student Aid Report (SAR). The SAR contains a summary of the information submitted on the FAFSA. The student should review the SAR for accuracy. If corrections are needed, they should be made and the SAR returned to the processor. If the FAFSA was completed and submitted electronically, the student may make any corrections on-line by returning to the FAFSA on the Web web-site.

Need Calculation and Expected Family Contribution

A student's need is calculated by taking the cost of attending the school and subtracting the expected family contribution.

The cost of attending school is determined by the individual school. It is done by estimating the costs of the following expenses:

- tuition and fees;

- books and supplies;

- room and board;

- transportation; and

- miscellaneous personal expenses.

Other expenses that may be included are:

- loan fees (origination and insurance fees that are part of the Federal Family Education Loan and Direct Loan programs);

- child or dependent care costs;

- study abroad;

- cooperative education employment costs; and

- expenses related to a disability (if not covered by another agency).

The amount the student and his/her parent(s) are expected to pay is the Expected Family Contribution (EFC). A contributed share is expected from the student and/or his/her parent(s). Both income and assets are taken into account when calculating EFC. Examples of assets can include:

- cash;

- savings;

- other bank accounts;

- equity in an investment property; and

- equity in a business.

There is no contribution expected from a student's parent(s) if the student is considered "independent". A student is considered independent if he/she is:

- at least 24 years old; or

- an orphan or ward of the court (until 18 years old); or

- veteran of the military; or

- supporting his/her own children; or

- married; or

- attending graduate or professional school.

If a student is determined to be dependent, the amount the family is expected to contribute is calculated using a formula established by the federal government. The formula used is the same no matter what school is chosen. The formula takes into account that the family needs income to cover necessary expenses of everyday living. These expenses include food, housing, clothing, taxes, insurance and other necessities. The formula calculates the contribution minus these expenses. As noted above, a family's assets are used in the calculation of EFC. The calculation recognizes the fact that significant portions of a family's assets need to be set aside for retirement. However, some of these assets may be used in determining EFC if it is determined that the assets exceed the amount needed for retirement. Also included in the calculation is the number of students attending college from the family.

In addition to the family contribution, the student is expected to contribute to his or her own education. The student is expected to contribute at a much higher level than the family. In the dependent student's case, the contribution is 50 percent of income (after taxes and allowances) and 35 percent of other assets.

There is a similar federally established formula for calculating the contribution of an independent student.

At times, the school can use "professional judgment" if it is determined that the EFC calculation does not truly reflect the current financial situation of the family. "Professional judgment" is used by the school's financial aid office. It is used if the financial aid professional feels that there are unusual circumstances that are not adequately addressed by the EFC formula. If professional judgment is used, there must be complete and accurate documentation of what was done and the reasons for the change. The school and the student should be aware that professional judgment does not transfer from one school to another.

Once the cost of education and the EFC are known, the school can then proceed in putting together a financial aid package for the student. The package can be made up of a combination of federal, state and school based aid available.

Calculations and Formula

Here is an EXAMPLE of a determination of need. Let's say the cost for a year's attendance for living on-campus at a school is $9,981. The student in question has been classified as a dependent.

The cost is broken down like this:

| Undergraduate Tuition | $3,405 |

| Housing | $2,778 |

| Meals | $1,948 |

| Books and Supplies | $600 |

| Transportation | $250 |

| Personal Expenses | $1,000 |

|

|

|

| TOTAL | $9,981 |

The federal formula has calculated an EFC of $2,300. This includes $600 that is expected from the student.

| Cost of Education | $9,981 |

| Estimated Family Contribution | – $2,300 |

|

|

|

| FINANCIAL NEED | = $7,681 |

The $7,681 is the amount that the school would use in putting together a need-based financial aid package for the student.

This is the formula used to calculate family contribution:

Parental Contribution

-

- Parent's total income (taxable and untaxed)

- – federal income tax (actual amount paid)

- – state and local taxes (standard allowance)

- – Social Security (FICA) taxes (actual amount paid)

- – Income Protection Allowance

- – Employment Expense Allowance (if both parents work or if the parent is a single head of household who works)

- = Available income

-

- Net worth of assets (value minus debts on assets)

- – Education Savings and Asset Protection Allowance

- = Discretionary net worth

- x Asset conversion rate

- = Contribution from assets

-

- Available income

- + Contribution from assets

- x Assessment percentage

- = Total parental contribution

-

- Total parental contribution

- ÷ by number in college

- = Parental contribution for student

Student Contribution (Dependent Student)

-

- Total income (taxable and untaxed)

- – federal income tax (actual amount paid)

- – state and local tax (standard allowance)

- – Social Security (FICA) taxes (actual amount paid)

- – Income Protection Allowance

- = Available income

- x .50

- = Contribution from income

-

- Total net assets

- x .35

- = Student's contribution from assets

-

- Student contribution from income

- + Student contribution from assets

- = Student contribution

Expected Family Contribution

- Parental contribution

- + Student contribution

- = Expected Family Contribution

Federal and State of Wisconsin Financial Aid Programs

There are a number of financial aid opportunities available through federal and State of Wisconsin programs.

The Title IV federal programs include:

- Federal Pell Grants

- Federal Stafford Loans (direct or through private lender)

- Subsidized or Unsubsidized

- Federal PLUS Loans (direct or through private lender)

- Campus Based Programs:

- Supplemental Educational Opportunity Grants

- Work-study

- Perkins Loans

- Tax Credits:

- Hope Tax Credit

- Lifetime Learning Tax Credit

State of Wisconsin programs include:

- Academic Excellence Scholarship

- Technical Excellence Scholarship

- Covenant Grant

- Hearing/Visually Impaired Student Grant

- Indian Student Assistance Grant

- Marquette Dental School Capitation Program

- Medical College of Wisconsin Capitation Program

- Minority Undergraduate Retention Grant

- Minority Teacher Loan

- Nursing Student Loan

- Talent Incentive Program Grant

- Teacher Education Loan

- Teacher of the Visually Impaired Loan

- Wisconsin Grant - UW; Technical, Private Non-Profit and Tribal colleges

Chapter 3 - School Eligibility

General Eligibility Provisions

HEAB has eligibility requirements for schools that wish to participate in the programs it administers. A school must meet these requirements in order for its students to be able to receive grants, scholarships or loans administered by HEAB.

The requirements are:

- the school must have proof of state and federal non-profit tax status;

- the school must be accredited through a federally accepted accrediting agency (HEAB recognizes the Higher Learning Commission of the North Central Association of Colleges and Schools);

- the school must be a degree-granting institution;

- the school must be Wisconsin based;

- the school must have an approved Satisfactory Academic Progress (SAP) Policy in place;

- the school must be eligible to participate in federal financial aid programs; and

- the school must agree to follow all statutes, rules, policies and procedures outlined for HEAB programs.

Distance Learning / Alternative Approaches

Distance Learning is a new and sometimes confusing aspect of financial aid. HEAB's rules regarding distance learning and eligibility for state funded financial aid are relatively simple:

The student must:

- be enrolled in a course of study that is at least one year in length and leads to a recognized certificate or the course is part of a program leading to a degree; and

- be enrolled in a participating Wisconsin school; and

- meet all of the eligibility requirements for the individual aid program, including full or part-time enrollment based on a 9 month academic year.

The school must:

- be a participating Wisconsin school; and

- have at least 50% of its programs leading to a degree or certificate; and

- have telecommunications courses account for less than 50% of the courses offered at the school.

As the use of distance learning increases in the future, HEAB will continue to monitor its policies and procedures to ensure that they remain consistent with other parts of the financial aid process.

School Closings

If a participating school plans to close, closes or stops providing instruction (for a reason other than normal vacation periods or as a result of a natural disaster that directly affects the school or its student), the school must immediately contact HEAB and comply with the following requirements:

- Within 45 days of the effective ending date of participation, submit to HEAB a dated letter of engagement for an audit by an independent public accountant of all HEAB program funds received. The completed audit report must be submitted to HEAB within 45 days after the date of the letter of engagement.

- Report to HEAB on the arrangements for retaining and storing (for the remainder of the appropriate storage period) all records concerning the school's management of the HEAB programs. Arrangements pertaining to the retention and storage of HEAB related documents must be deemed satisfactory by HEAB. Please Note: All HEAB related documents must be retained for at least seven (7) years.

- Refund student's unearned HEAB program funds.

Schools that close must refund to HEAB or, following specific written instructions from HEAB, otherwise distribute any unexpended HEAB program funds it has received.

Chapter 4 - Student Eligibility

General Eligibility Provisions

In order to receive HEAB funds, the student must meet Wisconsin statutory requirements and the federal admissions standards. Note: For the eligibility requirements of individual programs, please refer to the section for that program.

The student must:

- Be a bona-fide Wisconsin resident per Wisconsin Statute 36.27(2); and

- Be a citizen of the United States or an eligible noncitizen per federal student financial aid criteria; and

- Have a high school diploma or its recognized equivalent. Recognized equivalents include the General Education Development (GED) or High School Equivalency Diploma (HSED).

- A student who is delinquent in repaying and/or who owes state funds to HEAB should not be submitted for vouchering until the past due funds have been repaid or returned.

In order for a student studying abroad to be eligible for HEAB administered funds, the student must be considered to be enrolled at a participating Wisconsin school. For example, the participating school's registrar must consider the student to be a student at that school, and the student must be billed through the Business or Bursar's office as a registered student.

While HEAB follows the federal eligibility guidelines in almost all cases, there are three important situations where HEAB considers a student eligible for state aid even though the student would be ineligible for federal aid. The three situations are:

- a drug-related conviction;

- incarceration; and

- in default on a federally guaranteed student loan.

There is nothing in current state statutes or current state administrative code that would prohibit students who are in one or more of these situations from receiving state aid.

Child Support Delinquency

Per state statutory requirements, HEAB may not award certain types of aid to a student if HEAB receives certification from the Department of Workforce Development, Bureau of Child Support (BCS), that the student is delinquent in child support.

The programs affected by this statute are:

- Academic Excellence Scholarship

- Hearing/Visually Impaired Student Grant

- Indian Student Assistance Grant

- Minority Undergraduate Retention Grant

- Talent Incentive Program Grant

- Wisconsin Grant - UW; Technical, Private Non-Profit and Tribal colleges

Procedure

- Every week HEAB receives a report from the BCS. This report is called the "Lien Docket". Each Federal Data File that is loaded on a daily basis is run against the most recent BCS report. If the student being loaded from the Federal Data File is on the BCS report, the student's record is loaded with a delinquency edit. This means the student is delinquent and cannot receive most types of HEAB assistance.

- The school is informed of a student's delinquency on the Notification Report. Field #8 is labeled "Child Suprt". If "1" appears in this field the student is not eligible to receive state aid.

- It is the student's responsibility to clear the delinquency. This should be done by working with the Child Support Office in the county or counties where the delinquency has occurred. Two of the options available to the student are clearing the delinquency or entering into an Alternate Payment Plan (APP).

- If the delinquency is cleared, the Child Support Office will report this information to the BCS. The BCS will then reflect this information in their next report to HEAB. HEAB will then notify the school via the Notification Report.

- The APP is a payment plan the delinquent payer (student) enters into with the child support agency. The purpose of the plan is to prevent enforcement actions from being taken against the delinquent payer. Once an APP has been negotiated and signed, the Bureau of Child Support will notify HEAB.

- Once HEAB receives this notification, it will manually override the delinquency status on the Notification Report. The "1" status will be removed and the student will then be eligible for vouchering.

- If a school has any questions, it should call HEAB at (608) 267-2213 and ask for assistance.

Selective Service Registration

All programs administered by the Wisconsin Higher Educational Aids Board (HEAB) have a statutory requirement that eligible recipients be registered with the Selective Service Administration (SSA). This procedure ensures that the Selective Service requirement is applied in a uniform and equitable fashion.

Procedure

For the Hearing/Visually Impaired Student Grant, Indian Student Assistance Grant, Minority Undergraduate Retention Grant, Talent Incentive Program Grant, Teacher of the Visually Impaired Loan Program and the Wisconsin Grant:

Beginning with the 2006-07 academic year, HEAB is no longer rejecting student records based on the Selective Service registration flags on the federal ISIR. Therefore, it is no longer necessary to submit Selective Service overrides through File Maintenance. (The Selective Service registration requirement is included in the year-end audit guidelines.)

For the Academic Excellence Scholarship:

- All incoming, first-time nominees for the Academic Excellence Scholarship (AES) will be manually reviewed to determine the gender of the nominee. This determination will be based on information supplied by the high school making the nomination.

- If the nominee is female, no SSA check is required.

- If the nominee is male, the nominee will be checked for SSA registration using the SSA website.

- If the nominee is registered with the SSA and/or is temporarily exempt, the nominee will be cleared for further consideration.

- If the nominee is not registered and is not temporarily exempt, the nomination approval process will be stopped.

- The school and the nominee will be notified of the situation. It is the nominee's responsibility to provide acceptable documentation needed to make the nominee eligible for the AES. An example of acceptable documentation is a letter from the SSA showing either that the nominee is registered or is temporarily exempt.

- When acceptable documentation is received, reviewed and approved, the nominee will be cleared for further consideration.

- If acceptable documentation is not received, the nominee will be made ineligible for the AES.

- If the nominee is temporarily exempt because he is not yet 18 at the time of nomination, the nominee will be placed on a list. This list will be checked before the start of the 2nd academic year of the award, to determine if the recipient has registered with SSA after his 18th birthday.

- If the nominee has registered, he will remain eligible for the AES based on his continued eligibility under other criteria.

- If the recipient has not registered, he will not be eligible to continue to receive the AES.

- The recipient will be notified of this decision. It is the recipient's responsibility to provide acceptable documentation needed to make the recipient eligible for AES. An example of acceptable documentation is a letter from the SSA showing that the filer is registered.

- When acceptable documentation is received, reviewed and approved, the recipient will regain eligibility for the AES based on his eligibility under other criteria.

For the Marquette University School of Dentistry and Medical College of Wisconsin Capitation Programs:

- All incoming, first-time nominees for the capitation programs will be manually reviewed to determine the gender of the nominee. This determination will be made based on information supplied by the university and college.

- If the nominee is female, no SSA check is required.

- If the nominee is male, the nominee will be checked for SSA registration using the SSA website.

- If the nominee is registered with the SSA, not required to register or is temporarily exempt, the nominee will be cleared for further consideration.

- If the nominee is not registered or is not temporarily exempt, the nomination approval process will be stopped.

- The school will be notified of the situation. It is the school's responsibility, in conjunction with the nominee, to provide acceptable documentation needed to make the nominee eligible for capitation. An example of acceptable documentation is a letter from the SSA showing either that the nominee is registered, not required to register or is temporarily exempt.

- When acceptable documentation is received, reviewed and approved, the nominee will be cleared for further consideration.

- If acceptable documentation is not received, the nominee will be ineligible for the capitation program.

For the Teacher Education Loan:

- All incoming, first-time applicants for the Teacher Education Loan will be manually reviewed to determine the gender of the applicant. This determination will be made based on information supplied by the applicant.

- If the applicant is female, no SSA check is required.

- If the applicant is male, the applicant will be checked for SSA registration using the SSA website.

- If the applicant is registered with the SSA, not required to register or is temporarily exempt, the applicant will be cleared for further consideration.

- If the applicant is not registered or is not temporarily exempt, the application approval process will be stopped.

- The applicant and the Milwaukee Teacher Education Center will be notified of the situation. It is the applicant's responsibility to provide acceptable documentation needed to make the applicant eligible for the loan. An example of acceptable documentation is a letter from the SSA showing either that the applicant is registered, not required to register or is temporarily exempt.

- When acceptable documentation is received, reviewed and approved, the applicant will be cleared for further consideration.

- If acceptable documentation is not received, the applicant will be ineligible for the Teacher Education Loan.

For the Minnesota/Wisconsin Tuition Reciprocity Program:

- All incoming, first-time applicants for the Minnesota/Wisconsin Tuition Reciprocity Program will be manually reviewed to determine the gender of the applicant. This determination will be made based on information supplied by the applicant.

- If the applicant is female, no SSA check is required.

- If the applicant is male, the applicant will be checked for SSA registration using the SSA website.

- If the applicant is registered with the SSA and/or is temporarily exempt, the applicant will be cleared for further consideration.

- If the applicant is not registered and is not temporarily exempt, the application approval process will be stopped.

- The applicant will be notified of the situation. It is the applicant's responsibility to provide acceptable documentation needed to make the applicant eligible for reciprocity. An example of acceptable documentation is a letter from the SSA showing either that the applicant is registered or is temporarily exempt.

- When acceptable documentation is received, reviewed and approved, the applicant will be cleared for further consideration.

- If acceptable documentation is not received, the applicant will be made ineligible for reciprocity.

- If the applicant is temporarily exempt because he is not yet 18 at the time of application, the applicant will be placed on a list. This list will be checked before the start of the 2nd academic year of reciprocity, to determine if the recipient has registered with SSA after his 18th birthday.

- If the applicant has registered, he will remain eligible for reciprocity based on his continued eligibility under other criteria.

- If the applicant has not registered, he will not be eligible to continue to receive reciprocity.

- The applicant will be notified of this decision. It is the applicant's responsibility to provide acceptable documentation needed to make the applicant eligible for reciprocity. An example of acceptable documentation is a letter from the SSA showing that the filer is registered.

- When acceptable documentation is received, reviewed and approved, the applicant will regain eligibility for reciprocity based on his eligibility under other criteria.

For the Minority Teacher Loan Program:

- All incoming, first-time nominees for the Minority Teacher Loan will be manually reviewed to determine the gender of the nominee. This determination will be made based on information supplied by the college or university.

- If the nominee is female, no SSA check is required.

- If the nominee is male, the school shall indicate that acceptable documentation of SSA is on file at the school with the other nomination information. No male student should be forwarded to HEAB for consideration if the school does not have acceptable documentation.

- When verification of acceptable documentation is received with the application, HEAB will pass the nomination to award calculation.

- If verification of acceptable documentation is not received with the nomination, the process will stop. The school will be notified via e-mail that verification of acceptable documentation was not received with the nomination.

- When verification of acceptable documentation is received (either by updating the student's record with the federal processor or submitting file maintenance to HEAB) and approved by HEAB, the nomination will continue through the awarding process.

- If verification of acceptable documentation is not received, the nominee will remain ineligible to receive the Minority Teacher Loan.

For the Nursing Student Loan:

- All incoming first-time nominees for the Nursing Student Loan will be manually reviewed to determine the gender of the nominee. This determination will be made based on information supplied by the college or university.

- If the nominee is female, no SSA check is required.

- If the nominee is male, the school shall indicate that acceptable documentation of SSA is on file at the school with the other nomination information. No male student should be forwarded to HEAB for consideration if the school does not have acceptable documentation.

- If verification of acceptable documentation is not received with the nomination, the process will stop. The school will be notified via e-mail that verification of acceptable documentation was not received with the nomination.

- When verification of acceptable documentation is received (either by updating the student's record with the federal processor or submitting file maintenance to HEAB), the nomination will continue through the awarding process.

- If verification of acceptable documentation is not received, the nominee will remain ineligible to receive the Nursing Student Loan.

EdVest

Per statutory requirement, funds withdrawn from an EdVest account cannot be used when calculating eligibility for state funds. This procedure ensures that the EdVest requirement is applied in a uniform and equitable fashion.

Procedure

- Each year, HEAB receives a file from Office of the State Treasurer prior to the beginning of the new academic year. This file contains information regarding all EdVest accounts that will be active for the upcoming academic year.

- HEAB uses this file to identify FAFSA filers who may have reported EdVest funds among assets while completing the FAFSA.

- When the filers have been identified, a letter will be sent to all filers. The letter will explain the Wisconsin law regarding EdVest. It will also ask the filers to identify where the EdVest funds where reported on the FAFSA.

- Once the information requested is received from the filer, HEAB will remove the EdVest funds and re-calculate the EFC.

- HEAB will use the re-calculated EFC to determine what, if any, state funding the filer may be eligible to receive.

- If the re-calculation results in a new or changed award, the newly calculated EFC and the award calculation will be reported to the appropriate school and the student.

- The school may then use this information to voucher funds, if the student is eligible.

- If the re-calculation does not result in a new or changed award, no updated information will be sent to the appropriate school. A letter will be sent to the student explaining the re-calculation did not result in a new or changed award.

- If no response is received from the letter sent in #3, no further action will be taken.

Residency

Wisconsin residency is a uniform requirement throughout all of the programs that HEAB administers. Only State of Wisconsin residents are eligible to receive aid disbursed by HEAB. State Statute 36.27 specifies Wisconsin residency criteria that a student must meet in order to be considered eligible for programs administered by HEAB.

Following is a breakdown of the Wisconsin statutes outlining residency criteria according to the type of student: adult, minor or refugee. It is recommended that schools use the following criteria in reviewing residency for students.

Residency Status By Type of Student

In determining bona fide Wisconsin residence at the beginning of a semester or session and for the preceding 12 months the intent of the student (or parent/guardian) to establish and maintain a permanent home in Wisconsin is the main consideration. Intent may be demonstrated or disproved by factors including (but not limited to):

- timely filing of a Wisconsin income tax return of a type that only full-year Wisconsin residents can file; or

- voter registration in Wisconsin; or

- motor vehicle registration in Wisconsin; or

- possession of a Wisconsin operator's license; or

- place of employment; or

- self-support; or

- involvement in community activities in Wisconsin; or

- physical presence in Wisconsin for at least 12 months preceding the beginning of a semester or session for which the student registers; or

- a visa that permits indefinite residence in the United States, if the student is not a citizen of the United States.

Adult Student

An adult student is considered a resident if:

- the student has been a bona fide resident of Wisconsin for 12 months preceding the beginning of a semester or session for which the student registers; or

- the student is a dependent of his/her parents under 26 USC 152 (a), if one or both of the parents have been bona fide residents of Wisconsin for at least 12 months preceding the beginning of a semester or session for which the student registers; or

- the student has been employed as a migrant worker in Wisconsin for at least 2 months of each year for 3 of the 5 years preceding the beginning of a semester or session for which the student registers; or the student has been employed as a migrant worker in Wisconsin for at least 3 months of each year for 2 of the 5 years preceding the beginning of a semester or session for which the student registers; or the student's parent or legal guardian has been so employed while the student was a minor; or

- the student is a graduate of a Wisconsin high school and the parents are bona fide residents of Wisconsin for 12 months preceding the beginning of a semester or session for which the student registers; or

- the student is employed full-time in Wisconsin, was relocated to Wisconsin by his/her current employer or moved to Wisconsin for employment purposes and accepted his/her current employment before applying for admission to an institution or center and before moving provided the student demonstrates an intent to establish and maintain a permanent home in Wisconsin; or

- the student is the spouse of a person who meets the criteria in #5; or

- the student is a non-resident member of the armed forces or engaged in alternative service and is stationed in Wisconsin on active duty; or

- The student is the spouse of a person who meets the criteria in #7; or

- the student is a member of the armed forces who resides in Wisconsin and is stationed at a federal military installation located within 90 miles of the borders of Wisconsin; or

- The student is the spouse of a person who meets the criteria in #9.

Minor Student

A minor student is considered a resident if:

- One or both of the student's parents have been bona fide residents of Wisconsin for at least 12 months preceding the beginning of a semester or session for which the student registers; or

- the student has resided substantially in Wisconsin during the years of minority and at least 12 months preceding the beginning of a semester or session for which the student registers; or

- the student is under guardianship in Wisconsin pursuant to ch. 48 or 880 whose legal guardian has been a legal resident of Wisconsin for at least 12 months preceding the beginning of a semester or session for which the student registers; or

- the student's parent or legal guardian has been employed as a migrant worker in Wisconsin for at least 2 months of each year for 3 of the 5 years preceding the beginning of a semester or session for which the student registers; or the student's parent or legal guardian has been employed as a migrant worker in Wisconsin for at least 3 months of each year for 2 of the 5 years preceding the beginning of a semester or session for which the student registers; or

- the student is a graduate of a Wisconsin high school and the parents are bona fide residents of Wisconsin for 12 months preceding the beginning of a semester or session for which the student registers; or

- the student's parent was relocated to Wisconsin by his/her current employer or moved to Wisconsin for employment purposes and accepted his/her current employment before the student applied for admission to an institution or center and before moving provided the student's parent demonstrates an intent to establish and maintain a permanent home in Wisconsin; or

- the student's parent is a non-resident member of the armed forces or engaged in alternative service and is stationed in Wisconsin on active duty; or

- the student's parent is a member of the armed forces who resides in Wisconsin and is stationed at a federal military installation located within 90 miles of the borders of Wisconsin.

Refugee Student

A refugee student is considered a resident if:

The student is a refugee, as defined under 8 USC 1101 (a) (42), who moved to Wisconsin immediately upon arrival in the United States and who has resided in Wisconsin continuously since then, IF the student demonstrates intent to establish and maintain a permanent home in Wisconsin.

Residency Review Process for Grant and Scholarship Programs

Following is the current process HEAB uses to determine Wisconsin residency for a student:

- Initial determination is made by the HEAB mainframe computer programs based on information received from the federal government on the ISIR.

A dependent student is considered a non-resident if:

- The student's permanent address, the student's legal address, or the supporting (as listed on the FAFSA) parent's address indicates an out-of-state address, as reported on the FAFSA.

An independent student is considered a non-resident if:

- The permanent or legal state of residence is out-of-state, as reported on the FAFSA.

Both dependent and independent students are considered non-residents if:

- The permanent or legal state of residence is left blank on the FAFSA.

- Identified non-resident students are reported to schools on the Graduate, Non-resident Error Report.

- The school is responsible for the initial review of a student who appears on the error report. The school should identify students where the school's residency status differs from the status reported by HEAB.

- When a student with a differing residency status has been identified, the school should contact HEAB. The school should e-mail the program coordinator at HEAB verifying that the school has the appropriate documentation on file to show that the student should be considered a Wisconsin resident.

- If the financial aid administrator has a question about the students' residency, the administrator may contact the HEAB grant coordinator for a determination. If it remains unclear as to whether or not a student meets the statutory requirements for state residency, the financial aid administrator must request that the student complete a Residency Determination Form. Once completed, the student must submit the Residency Determination Form to the financial aid administrator for a review and determination.

- The student is given the opportunity to appeal a denial to the Executive Secretary if the determination is made by HEAB.

- If the Executive Secretary approves residency appeal, the Executive Secretary contacts both the student and the school by letter or e-mail.

- If the Executive Secretary upholds the denial, the Executive Secretary contacts both the student and the school by letter or e-mail.

- The decision of the Executive Secretary is final.

Effects of Professional judgment Adjustment

As mentioned previously, a change to a student's EFC based on professional judgment does not transfer from one school to another. When a student transfers from one school to another between terms, the second school may re-calculate the student's EFC if the first school used professional judgment in determining the EFC.

HEAB has a policy regarding the awarding of funds to a student that is in this situation. It is HEAB's policy to honor the professional judgment and calculations of each school. When necessary a manual adjustment is made to allow a student to receive additional funds.

Here is an example:

A school uses professional judgment and calculates an EFC for a student. This makes the student eligible for a WG of $1000. The school submits a voucher request to HEAB and the student receives $500 for the first semester. The student then transfers to a different school for the second semester. The second school recalculates the student's EFC. This makes the student eligible for a WG of only $400. The second school submits a voucher request to HEAB for $200. While technically the student, based on the second school's EFC calculation, has already received more ($500) in the first semester than he/she is eligible for, HEAB will make a manual adjustment to the system in order to award the student the $200.

If the reverse situation occurs (a higher eligibility at the second school) HEAB will voucher for half of the higher total eligibility.

Outside Funding Sources

At times, a student may be eligible for outside sources of funding. These outside funding sources may give the student up to the equivalent of the cost of tuition, fees, books, supplies and room & board.

Please note that a student who may be eligible for this type of outside funding may also be eligible for programs administered by HEAB as long as the student meets the program eligibility criteria and will not be over awarded.

Chapter 5 - State of Wisconsin Financial Aid Programs

Academic Excellence Scholarship (AES)

Overview

This program provides scholarships to selected 12th grade students who have the highest grade point average in each public and private school in the state. The number of scholarships for which each high school is eligible is based on the total student enrollment (grades 9-12).

The scholarships are awarded based on the following formula:

| Enrollment | Number of scholarships |

|---|---|

| 1-79 | Compete statewide for 10 scholarships |

| 80-499 | one scholarship |

| 500-999 | two scholarships |

| 1000-1499 | three scholarships |

| 1500-1999 | four scholarships |

| 2000-2499 | five scholarships |

| Over 2500 | six scholarships |

Students receive a maximum of $2,250 per year to be applied towards tuition. Half of the scholarship is funded by the state and half by the school. Tuition and fees in excess of $2,250 is the responsibility of the student. Students may attend any UW, private or Technical school in Wisconsin with an AES.

Funds available for this program are based on a nine-month academic period.

Eligibility

In order to receive this scholarship, the student must:

- be enrolled in a participating UW, Wisconsin Technical College or private, non-profit post-secondary institution in the State by September 30th of the academic year following the year in which the student graduated from high school;

- be enrolled on a full-time basis (as determined by the school) in a degree, certificate, or 2-year vocational diploma program;

- make satisfactory academic progress (per federal student financial aid criteria);

- meet the Wisconsin residency requirements (see Residency section of this manual); and

- maintain at least a 3.000 cumulative grade point average.

- No student is eligible for more than four years (or eight semesters) at a UW or private, non-profit post-secondary institution. No student is eligible for more than three years (or six semesters) at a Wisconsin Technical College.

Application Process

-

Schools With Total Enrollments Greater Than 80 Students:

- The school board or governing board at each public or private high school makes a selection.

- The school board or governing board is required to name the 12th grade student with the highest grade point average, as normally determined by the high school. This selection must be made by February 15th.

- If two or more students in the same high school have the same grade point average, the faculty is required to select the student to receive the scholarship and designate the other student as the alternate. If the high school uses a weighted grading system, the student with the next highest GPA may be designated as an alternate.

- The school forwards the name of the selected student to HEAB.

- HEAB informs the student of his/her selection and supplies information regarding the scholarship and how to use it.

- HEAB administrative rules require each high school to have a written policy that describes their grading system, tie-breaking procedures and criteria used to determine and rank scholars.

- If the student does not use the scholarship by September 30th following the high school graduation, the scholarship is awarded to the alternate.

-

Schools With Total Enrollments Less than 80 Students:

- The 10 students from public or private high schools with the highest grade point averages are selected, per HEAB administrative rules.

- If there is a tie, students are chosen based on their ACT or SAT scores and then on the quality and content of letters submitted by the students, listing the reasons they feel qualified to receive the scholarship.

- HEAB processes the information for each recipient.

- Each school that has AES recipients will receive a Notification Report that lists only AES recipients. This report is scheduled to be sent out monthly in August and September, and as needed at other times of the year.

- Once this special Notification Report is received, the school can submit a voucher request for the eligible student(s). The school should follow the voucher procedure outlined in the Vouchering section of this manual.

- In late May, HEAB will send a Verification Report (G.P.A., credits taken, etc.) to each school with AES student(s). The school must complete the report and return it to HEAB as soon as possible. This report is available in paper or electronic formats.

- If, based on the report, the student continues to meet eligibility requirements (see "Eligibility" above for specific criteria), the AES is automatically renewed for the next academic year.

- If, based on the report, the student does not meet eligibility requirements; the student is informed by HEAB of the loss of the AES by letter. The school is sent a copy of the letter.

AES Notification Report

There is a separate notification report for the Academic Excellence Scholarship program. This report is sent to all participating institutions that have an enrolled AES student. The report is scheduled to be sent out regularly during the fall-spring-summer school year and monthly during July and August. The AES Notification Report is provided in two formats: a printable report file and a flat text file.

AES Notification Report Sample - Printable Format

STATE OF WISCONSIN 00:00 day, month 00, 0000

0000 - 00 ACADEMIC EXCELLENCE

NOTIFICATION LIST

LNAME FNAME SSN YRIN AWARD VAMT RAMT REMAINING COUNT

XXXXXXXXXXXXX XXXXXXXXXX 999999999 1 1125.0 0 0 1125.0 1

XXXXXXXXXXXXX XXXXXXXXXX 999999999 1 1125.0 0 0 1125.0 1

XXXXXXXXXXXXX XXXXXXXXXX 999999999 2 1125.0 0 0 1125.0 1

XXXXXXXXXXXXX XXXXXXXXXX 999999999 3 1125.0 0 0 1125.0 1

XXXXXXXXXXXXX XXXXXXXXXX 999999999 4 1125.0 0 0 1125.0 1

XXXXXXXXXXXXX XXXXXXXXXX 999999999 1 1125.0 0 0 1125.0 1

XXXXXXXXXXXXX XXXXXXXXXX 999999999 3 1125.0 0 0 1125.0 1

XXXXXXXXXXXXX XXXXXXXXXX 999999999 3 1125.0 0 0 1125.0 1

XXXXXXXXXXXXX XXXXXXXXXX 999999999 4 1125.0 0 0 1125.0 1

XXXXXXXXXXXXX XXXXXXXXXX 999999999 3 1125.0 0 0 1125.0 1

XXXXXXXXXXXXX XXXXXXXXXX 999999999 4 1125.0 0 0 1125.0 1

XXXXXXXXXXXXX XXXXXXXXXX 999999999 3 1125.0 0 0 1125.0 1

XXXXXXXXXXXXX XXXXXXXXXX 999999999 3 1125.0 0 0 1125.0 1

XXXXXXXXXXXXX XXXXXXXXXX 999999999 1 1125.0 0 0 1125.0 1

XXXXXXXXXXXXX XXXXXXXXXX 999999999 2 1125.0 0 0 1125.0 1

XXXXXXXXXXXXX XXXXXXXXXX 999999999 2 1125.0 0 0 1125.0 1

XXXXXXXXXXXXX XXXXXXXXXX 999999999 2 1125.0 0 0 1125.0 1

XXXXXXXXXXXXX XXXXXXXXXX 999999999 2 1125.0 0 0 1125.0 1

XXXXXXXXXXXXX XXXXXXXXXX 999999999 4 1125.0 0 0 1125.0 1

XXXXXXXXXXXXX XXXXXXXXXX 999999999 2 1125.0 0 0 1125.0 1

XXXXXXXXXXXXX XXXXXXXXXX 999999999 3 1125.0 0 0 1125.0 1

XXXXXXXXXXXXX XXXXXXXXXX 999999999 2 1125.0 0 0 1125.0 1

XXXXXXXXXXXXX XXXXXXXXXX 999999999 3 1125.0 0 0 1125.0 1

XXXXXXXXXXXXX XXXXXXXXXX 999999999 2 1125.0 0 0 1125.0 1

XXXXXXXXXXXXX XXXXXXXXXX 999999999 3 1125.0 0 0 1125.0 1

There are 9 fields on the Printable AES Notification Report. Following is a field-by-field breakdown on how to read and use the AES Notification Report.

- LNAME

The student's last name. - FNAME

The student's first name. - SSN

The student's social security number. - YRIN

The student's year in school.

1 = Freshman

2 = Sophomore

3 = Junior

4 = Senior

5 = Fifth year senior or other undergraduate status - AWARD

The amount of the student's AES award that HEAB provides for the year. The school is responsible for the same amount.

This is the field that is used for vouchering. You can request half of the amount shown in this field for each semester of the current academic year. Some seniors will be listed with just a one-semester award; request that amount for the semester. - VAMT

The amount of money that has been paid out for the student for the current academic year. - RAMT

The amount of money refunded for the student for the current academic year. - REMAINING

The amount of money that remains available for the student for the current academic year. - COUNT

A number used by HEAB to calculate total numbers of students.

AES Notification Report Sample - Flat File Format

999999999 XXXXXXXXXXXXXXX XXXXXXXXXXXXX XXXXX XXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXX WI XXXXX00003000 1125.00 0.00 0.00 1125.00 999999999 XXXXXXXXXXXXXXX XXXXXXXXXXXXX XXXXX XXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXX WI XXXXX00002000 1125.00 0.00 0.00 1125.00 999999999 XXXXXXXXXXXXXXX XXXXXXXXXXXXX XXXXX XXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXX WI XXXXX00004000 1125.00 0.00 0.00 1125.00 999999999 XXXXXXXXXXXXXXX XXXXXXXXXXXXX XXXXX XXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXX WI XXXXX00004000 1125.00 0.00 0.00 1125.00 999999999 XXXXXXXXXXXXXXX XXXXXXXXXXXXX XXXXX XXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXX WI XXXXX00003000 1125.00 0.00 0.00 1125.00 999999999 XXXXXXXXXXXXXXX XXXXXXXXXXXXX XXXXX XXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXX WI XXXXX00001000 1125.00 0.00 0.00 1125.00 999999999 XXXXXXXXXXXXXXX XXXXXXXXXXXXX XXXXX XXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXX WI XXXXX00003000 1125.00 0.00 0.00 1125.00 999999999 XXXXXXXXXXXXXXX XXXXXXXXXXXXX XXXXX XXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXX WI XXXXX00001000 1125.00 0.00 0.00 1125.00 999999999 XXXXXXXXXXXXXXX XXXXXXXXXXXXX XXXXX XXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXX WI XXXXX00003000 1125.00 0.00 0.00 1125.00 999999999 XXXXXXXXXXXXXXX XXXXXXXXXXXXX XXXXX XXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXX WI XXXXX00003000 1125.00 0.00 0.00 1125.00 999999999 XXXXXXXXXXXXXXX XXXXXXXXXXXXX XXXXX XXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXX WI XXXXX00004000 1125.00 0.00 0.00 1125.00 999999999 XXXXXXXXXXXXXXX XXXXXXXXXXXXX XXXXX XXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXX WI XXXXX00001000 1125.00 0.00 0.00 1125.00 999999999 XXXXXXXXXXXXXXX XXXXXXXXXXXXX XXXXX XXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXX WI XXXXX00001000 1125.00 0.00 0.00 1125.00 999999999 XXXXXXXXXXXXXXX XXXXXXXXXXXXX XXXXX XXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXX WI XXXXX00001000 1125.00 0.00 0.00 1125.00 999999999 XXXXXXXXXXXXXXX XXXXXXXXXXXXX XXXXX XXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXX WI XXXXX00003000 1125.00 0.00 0.00 1125.00 999999999 XXXXXXXXXXXXXXX XXXXXXXXXXXXX XXXXX XXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXX WI XXXXX00001000 1125.00 0.00 0.00 1125.00 999999999 XXXXXXXXXXXXXXX XXXXXXXXXXXXX XXXXX XXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXX WI XXXXX00004000 1125.00 0.00 0.00 1125.00 999999999 XXXXXXXXXXXXXXX XXXXXXXXXXXXX XXXXX XXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXX WI XXXXX00003000 1125.00 0.00 0.00 1125.00 999999999 XXXXXXXXXXXXXXX XXXXXXXXXXXXX XXXXX XXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXX WI XXXXX00002000 1125.00 0.00 0.00 1125.00 999999999 XXXXXXXXXXXXXXX XXXXXXXXXXXXX XXXXX XXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXX WI XXXXX00003000 1125.00 0.00 0.00 1125.00 999999999 XXXXXXXXXXXXXXX XXXXXXXXXXXXX XXXXX XXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXX WI XXXXX00002000 1125.00 0.00 0.00 1125.00 999999999 XXXXXXXXXXXXXXX XXXXXXXXXXXXX XXXXX XXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXX WI XXXXX00004000 1125.00 0.00 0.00 1125.00 999999999 XXXXXXXXXXXXXXX XXXXXXXXXXXXX XXXXX XXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXX WI XXXXX00004000 1125.00 0.00 0.00 1125.00 999999999 XXXXXXXXXXXXXXX XXXXXXXXXXXXX XXXXX XXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXX WI XXXXX00003000 1125.00 0.00 0.00 1125.00 999999999 XXXXXXXXXXXXXXX XXXXXXXXXXXXX XXXXX XXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXX WI XXXXX00003000 1125.00 0.00 0.00 1125.00

There are 14 fields on the Flat File AES Notification Report. Each record is 144 characters wide. Following is a field-by-field breakdown on how to read and use this report.

- The student's social security number.

This field begins in position 1. - The student's last name.

This field begins in position 11. - The student's first name.

This field begins in position 28. - The student's street address.

This field begins in position 43. - The student's city.

This field begins in position 71. - The student's state.

This field begins in position 88. - The student's zip code.

This field begins in position 91. - The current academic year.

This field begins in position 96. - The student's year in school.

1 = Freshman

2 = Sophomore

3 = Junior

4 = Senior

5 = Fifth year senior or other undergraduate status

This field begins in position 100. - The three digit school code assigned by HEAB to the institution.

This field begins in position 101. - The amount of the student's AES award that HEAB provides for the year. The school is responsible for the same amount.

This is the field that is used for vouchering. You can request half of the amount shown in this field for each semester of the current academic year. Some seniors will be listed with just a one-semester award; request that amount for the semester.

This field begins in position 107. - The amount of money that has been paid out for the student for the current academic year.

This field begins in position 118. - The amount of money refunded for the student for the current academic year.

This field begins in position 126. - The amount of money that remains available for the student for the current academic year.

This field begins in position 138.

AES Enrollment Verification Report

The Enrollment Verification Report is used to obtain information that helps HEAB to determine if an AES recipient is eligible for another year of the scholarship. This report is sent to all participating institutions that have an enrolled AES student.

The report is sent out once a year in May. The report is sent electronically by e-mail to the participating institution. If the institution cannot process an electronic file, a paper report can be sent.

AES Enrollment Verification Report Sample

1 STATE OF WISCONSIN - HIGHER EDUCATIONAL AIDS BOARD DATE: 00/00/00

ACADEMIC EXCELLENCE SCHOLARSHIP PAGE: 1

0 0000-00 ACADEMIC YEAR ENROLLMENT STATUS REPORT

0 000 SCHOOL NAME

0 --1ST TERM-- --2ND TERM-- --3RD TERM-- ----FINAL---

CREDITS CREDITS CREDITS CUM CR CUM

NAME & ADDRESS S S N YEAR EARNED GPA EARNED GPA EARNED GPA EARNED GPA

0

-XXXXXXXXXX XXXXXXXXXX 999-99-9999 1

XXXXX XXXXXXXXXX

XXXXXXXXXX, WI XXXXX ___.__ _.__ ___.__ _.__ ___.__ _.__ ___.__ _.__

-XXXXXXXXXX XXXXXXXXXX 999-99-9999 1

XXXXX XXXXXXXXXX

XXXXXXXXXX, WI XXXXX ___.__ _.__ ___.__ _.__ ___.__ _.__ ___.__ _.__

-XXXXXXXXXX XXXXXXXXXX 999-99-9999 2

XXXXX XXXXXXXXXX

XXXXXXXXXX, WI XXXXX ___.__ _.__ ___.__ _.__ ___.__ _.__ ___.__ _.__

-XXXXXXXXXX XXXXXXXXXX 999-99-9999 2

XXXXX XXXXXXXXXX

XXXXXXXXXX, WI XXXXX ___.__ _.__ ___.__ _.__ ___.__ _.__ ___.__ _.__

-XXXXXXXXXX XXXXXXXXXX 999-99-9999 3

XXXXX XXXXXXXXXX

XXXXXXXXXX, WI XXXXX ___.__ _.__ ___.__ _.__ ___.__ _.__ ___.__ _.__

-XXXXXXXXXX XXXXXXXXXX 999-99-9999 3

XXXXX XXXXXXXXXX

XXXXXXXXXX, WI XXXXX ___.__ _.__ ___.__ _.__ ___.__ _.__ ___.__ _.__

-XXXXXXXXXX XXXXXXXXXX 999-99-9999 4

XXXXX XXXXXXXXXX

XXXXXXXXXX, WI XXXXX ___.__ _.__ ___.__ _.__ ___.__ _.__ ___.__ _.__

-

***** STUDENT COUNT: 7 I HEARBY CERTIFY THAT THE CREDIT AND

GRADE POINT AVERAGE INFORMATION LISTED SIGNATURE:___________________ NAME:___________________

FOR MY INSTITUTION'S 0000-00 ACADEMIC

EXCELLENCE SCHOLARS IS TRUE AND CORRECT. TITLE:_______________________________ DATE:___/___/___

There are eleven fields on the AES Enrollment Verification Report. Following is a field by field breakdown on how to read and use the report.

- NAME & ADDRESS

The student's last name, first name, and address where the student lives. - SSN

The student's social security number. - YEAR

The student's year in school.

1 = Freshman

2 = Sophomore

3 = Junior

4 = Senior

5 = Fifth year senior or other undergraduate status - 1ST TERM CREDITS EARNED

The number of credits the student earned in the first term of the most recent academic year. - 1ST TERM GPA

The grade point average the student earned in the first term of the most recent academic year. - 2ND TERM CREDITS EARNED

The number of credits the student earned in the second term of the most recent academic year. - 2ND TERM GPA

The grade point average the student earned in the second term of the most recent academic year. - 3RD TERM CREDITS EARNED

The number of credits the student earned in the third term (if the school uses trimesters) of the most recent academic year. - 3RD TERM GPA

The grade point average the student earned in the third term (if the school uses trimesters) of the most recent academic year. - FINAL CUMULATIVE CREDITS EARNED

The total number of credits the student has earned while attending this institution. - FINAL CUMULATIVE GPA

The cumulative grade point average the student has earned while attending this institution.

Hearing/Visually Impaired Student Grant

Overview

This program provides grants to Wisconsin residents who are enrolled as undergraduates at an in-state public or private, non-profit post-secondary institution and who have a hearing or visual impairment. In addition, there is a selective list of out-of-state institutions that are approved to participate in this program.

The grant is based on financial need. Students are eligible for a minimum of $250 up to a maximum grant of $1,800 per year for up to ten semesters. This grant is in addition to WG. Additional costs of education such as special equipment or materials are included along with the standard student budget.

Funds available for this program are based on a nine-month budget.

Eligibility

In order to receive this grant, the student must:

- be enrolled in a participating UW, Wisconsin Technical College or private, non-profit post-secondary institution in the state;

- be enrolled at least half-time (as determined by the school) in a degree or certificate program;

- make satisfactory academic progress (per federal student financial aid criteria);

- meet the Wisconsin residency requirements (see Residency section of this manual);

- demonstrate financial need; and

- be deaf or hard of hearing or visually impaired. For purposes of this grant the hearing loss must be 40 decibels or greater in the better ear and/or the vision loss must be 20/200 or less in the better eye or the field of vision must be 20 degrees or less in the better eye.

- Maximum eligibility for this grant is ten (10) semesters.

Application Process

- The student must complete and submit a FAFSA form for processing.

- The student must complete an application for the grant. The application form, Wisconsin Hearing/Visually Impaired Program, can be obtained through the school or by contacting HEAB.

- The student must complete the first part of the form.

- The second part of the form must be certified and signed by a medical professional.

- Once completed, the form is sent to HEAB.

- HEAB reviews the form.

- Once the form has been reviewed and it has been determined that the student is eligible, HEAB contacts the school by e-mail. HEAB asks the school to determine the financial need of the student and the amount of award for which the student is eligible.

- Once HEAB has this information, the Notification Report is updated to show the amount of award available to the student.

- Once the revised Notification Report is received, the school can submit a voucher request for the eligible student(s). The school should follow the voucher procedure outlined in the Vouchering section of this manual.

- The first part of the Wisconsin Hearing/Visually Impaired Program form needs to be completed and sent to HEAB for processing every year the student wishes to receive the grant.

The medical certification (Part II of the form) does NOT need to be completed past the initial application.